Master Financial Analysis Through Real-World Practice

Learn the core skills that financial professionals actually use daily. Our approach focuses on practical techniques that make sense in real business situations, not just theoretical concepts.

Explore Our Programs

How We Approach Financial Education

Our teaching method connects spreadsheet skills with business decision-making. You'll work with actual financial scenarios that mirror what analysts face in their jobs.

Case-Based Learning Framework

-

Start with Real Companies

We begin each module by examining actual financial statements from companies you know. This helps you see patterns and understand why certain ratios matter.

-

Build Models Step-by-Step

Instead of jumping into complex formulas, we show you how to construct financial models piece by piece. You'll understand the logic behind each calculation.

-

Practice Decision Scenarios

Every lesson includes situations where you need to interpret your analysis and make recommendations. This bridges the gap between numbers and business judgment.

Step-by-Step Learning Modules

Each topic builds systematically on previous knowledge. We've designed these modules based on feedback from working analysts about what they wish they'd learned first.

Reading Financial Statements

Learn to extract meaningful insights from balance sheets, income statements, and cash flow reports.

Ratio Analysis Mastery

Move beyond basic calculations to understand what ratios actually tell you about business performance.

Valuation Techniques

Practical approaches to determining what companies are worth using multiple valuation methods.

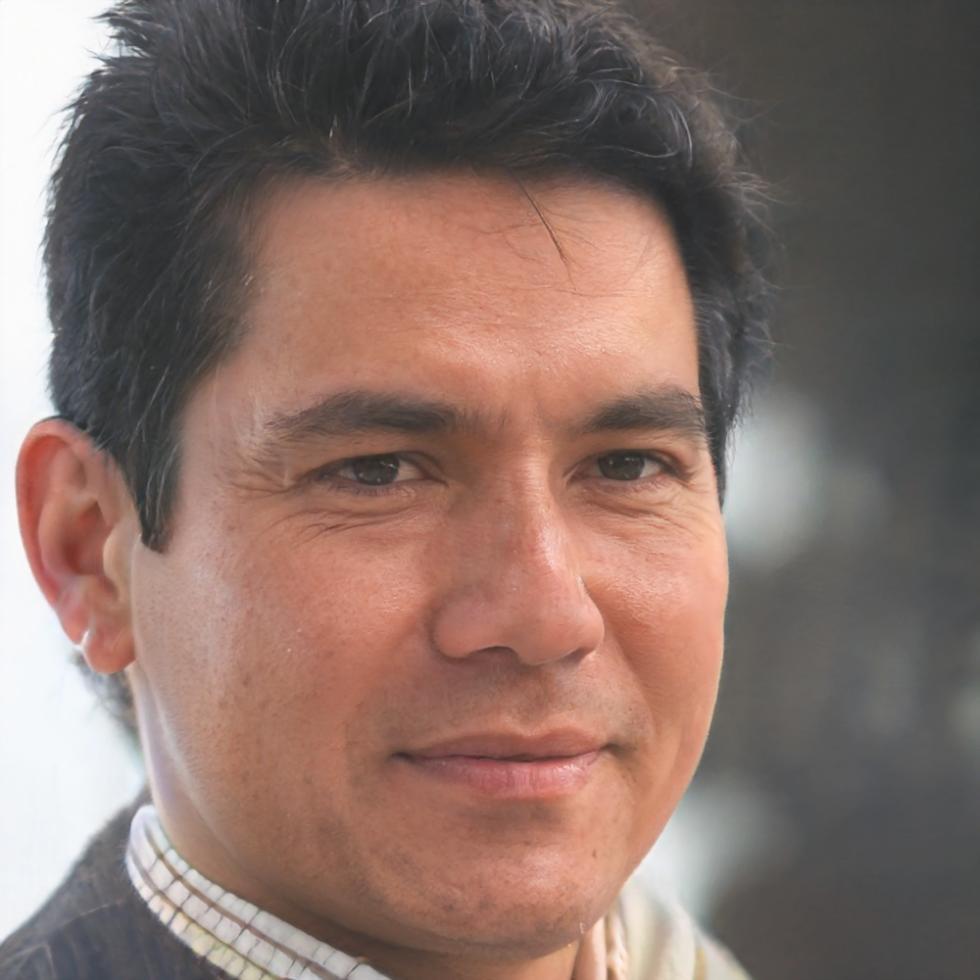

Learning from Hands-On Experience

Marcus Thorne spent twelve years analyzing companies for investment firms before transitioning to education. He's seen firsthand how theoretical knowledge often fails to prepare analysts for the messiness of real financial data.

- Built valuation models for over 200 companies across various industries

- Former Senior Analyst at Meridian Capital Partners

- Developed training programs used by three major Australian investment firms

- CFA charterholder with focus on equity analysis

Your Path to Financial Analysis Confidence

We recommend starting in the middle of 2025 to give you time to prepare and ensure you can dedicate proper attention to the coursework.

Foundation Program Begins

Six-week intensive covering financial statement analysis and basic modeling skills. Classes meet twice weekly with practical assignments.

Advanced Techniques Module

Focus on valuation methods, industry-specific analysis, and building presentations for business stakeholders.

Capstone Project

Complete analysis of a company of your choosing, presenting findings to a panel of working financial professionals.